Credit Card Cashback: Turning Everyday Expenses into Extra Income Photo by Emil Kalibradov on Unsplash Let me begin this article by explaining why, when I started my career as a business analyst in a company, I searched online for ways to earn money through passive income ideas due to a lack of salary. I came across a…

New born Investment Options in India: Securing Your Baby’s Future

Newborn Investment Options in India: Securing Your Baby’s Future Photo by Kelly Sikkema on Unsplash Certainly! Let’s delve deeper into each investment option suitable for securing your newborn baby’s financial future in India: 1. Sukanya Samriddhi Yojana (SSY): — SSY is a government-backed savings scheme aimed at providing financial security for the girl child. — It offers an attractive…

The Truth About Credit Card Minimum Payments: What You Need to Know for Better Financial Health

In today’s world, credit cards have become a ubiquitous tool for managing finances, offering convenience and perks like points, miles, and cashback. However, there’s a hidden trap that many people fall into — the minimum payment illusion. It’s time to unravel this misconception and shed light on the crucial aspects of credit card payments that…

Understanding the Basics of Economics and its Impact on Personal Finance

Economics, often considered an abstract discipline, is deeply intertwined with our everyday lives, especially when it comes to managing personal finances. At its core, economics studies the allocation of scarce resources among unlimited human wants and needs. This fundamental principle plays a crucial role in how individuals make decisions about earning, spending, saving, and investing…

7 Ingenious Strategies for Earning Money with Your Credit Card

Many people are familiar with the challenge of having too much credit card debt, something that can impact households across the board. In a survey conducted by GOBankingRates.com in 2016, it was found that the typical amount owed on a credit card is around $2,000, which is a common situation for many individuals. If you…

Mastering Your Finances: Top 5 Strategies for Saving Money and Building Wealth

Introduction: In an ever-changing financial landscape, mastering your finances through effective saving and wealth-building strategies is paramount. These practices not only provide security during uncertain times but also pave the way for a comfortable and prosperous future. In this comprehensive guide, we will delve into the top five strategies for saving money and building wealth….

Top YouTube Channels for Personal Finance: Learn, Engage, and Take Control

Title: Top YouTube Channels for Personal Finance: Learn, Engage, and Take Control Introduction: In today’s digital age, YouTube has become an invaluable resource for learning about personal finance. Whether you’re a personal finance beginner or an experienced investor, the platform offers a wide range of channels that provide free, specific, and insightful content. In this…

Mastering the Basics of Economics: Unlocking the Secrets to Economic Success

Introduction: Are you fascinated by the inner workings of economies? Do you want to understand how supply and demand shape market dynamics, or how government policies impact economic growth? Look no further! Our latest ebook, “Economics 101: A Comprehensive Guide to Understanding the Basics of Economics,” is here to demystify the world of economics and…

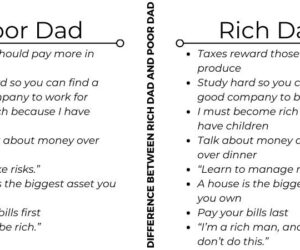

रिच डैड पुअर डैड Rich Dad Poor Dad Book Summary Hindi | Robert Kiyosaki

रॉबर्ट कियोसाकी के दो पिता थे। एक पिता वे अपने वास्तविक पिता कहलाते थे, जिन्हें वे “पूर डैड” कहते थे। दूसरे पिता उनके मित्र के पिता थे, जिन्हें वे “रिच डैड” कहते थे। दोनों पिताजी अपने करियर में सफल थे। पूर डैड बहुत पढ़े-लिखे और बुद्धिमान थे, उन्होंने एक PHD भी प्राप्त की थी, लेकिन…

Rich Dad Poor Dad: A Path to Financial Wisdom and Independence – Book Summary

In Robert Kiyosaki’s groundbreaking book, “Rich Dad Poor Dad,” readers are taken on a transformative journey into the world of personal finance. With a narrative centered around the contrasting teachings of his real dad (poor dad) and his friend’s dad (rich dad), Kiyosaki challenges conventional beliefs about money and wealth. Through a series of invaluable…