Introduction

Most of us grow up believing that a good job and steady salary are enough to make us rich. I thought the same when I started my career 12 years ago. But over time, I realized something important: a salary gives you stability, not wealth.

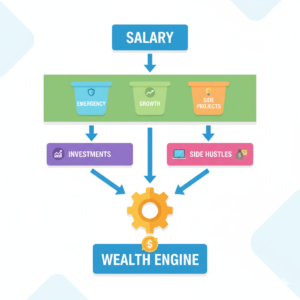

If you want to achieve financial freedom, you need a parallel system that works for you even when you’re not working. Let me share the system I built through trial, error, and consistent effort — in simple words that anyone can follow.

Why Salary Alone Isn’t Enough

-

Limited growth: Your salary grows slowly, and promotions are uncertain.

-

Inflation impact: A 5% salary hike means little when inflation eats 4–6% every year.

-

Time dependency: More money usually means more working hours, which is not scalable.

Conclusion? Salary keeps the bills paid but doesn’t create wealth.

The Parallel Wealth System

After 12 years of experimenting, I built what I call the Parallel Wealth System. It’s a simple framework that runs beside your job:

Step 1. Save First, Spend Later

Move at least 15–20% of your income into savings before paying bills or shopping.

Step 2. Split into Buckets

-

Emergency buffer (safety net)

-

Growth / investments (mutual funds, SIPs, index funds, PPF, NPS, or small real estate)

-

Learning & side projects (courses, freelancing, digital experiments)

Step 3. Automate the Flow

Set auto-transfers on salary day. If money stays in your account, you’ll spend it.

Step 4. Grow Your Investments

Let the “growth bucket” compound with time. SIPs in equity mutual funds, index ETFs, or recurring deposits can work depending on your risk level.

Step 5. Build Side Income

Use weekends or evenings to test side hustles:

-

Freelancing (content writing, design, consulting)

-

Selling online (Amazon, Flipkart, Shopify)

-

Digital products (courses, ebooks, templates)

-

Blogging / YouTube / affiliate marketing

Step 6. Reinvest Profits

Don’t withdraw everything. Reinvest at least 50% of side income or investment gains back into your growth bucket.

Step 7. Review Annually

Once a year, ask yourself:

-

Did my wealth engine grow?

-

Which side hustle worked?

-

Where can I rebalance my investments?

Example (Simple Numbers)

Suppose your salary is ₹50,000/month.

-

Save 20% → ₹10,000

-

₹4,000 → Emergency buffer

-

₹4,000 → Investments (SIP in mutual funds)

-

₹2,000 → Learning & side projects

-

At year-end:

-

Investments grow by 10% → ₹4,800 extra

-

Side project earns ₹20,000 extra

Repeat this cycle for 5–10 years → your parallel wealth engine can start matching (or even exceeding) your salary.

Lessons From My 12 Years

✅ Don’t put all money in one place (diversify)

✅ Small, steady savings matter more than big, irregular ones

✅ Be patient — compounding is slow but powerful

✅ Keep learning new skills every year

❌ Avoid high-interest loans for “investing” — it backfires

Conclusion

A salary gives you security, but wealth comes from systems, not jobs. Build your parallel wealth engine today — with savings, investments, and side hustles — and within a few years you’ll have the freedom to choose how you want to live, not just how much you can earn.